We announced a remarkable financial result in the first half, delivered against the backdrop of the most disruptive period of the pandemic so far, highlighting the strength of the Wesfarmers portfolio and the capacity of divisional teams to adjust rapidly to meet customer demand.

During the half there were 34,000 store trading days that were impacted by trading restrictions, representing almost 20 percent of total store trading days for the half. Despite these restrictions, we continued to support our team members through payroll and assistance programs.

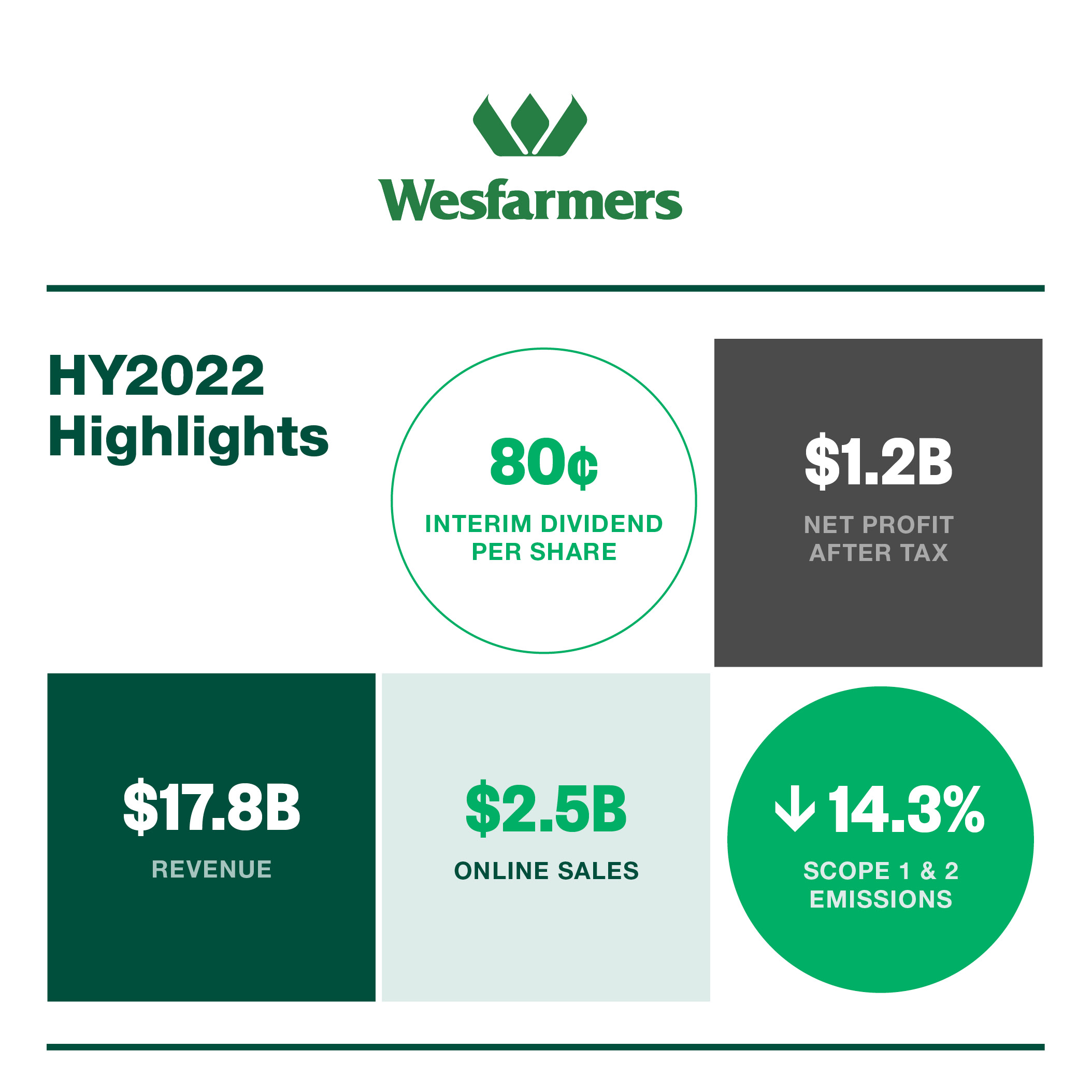

We were pleased to report net profit after tax of $1.2 billion and a fully-franked interim dividend of 80 cents per share.

Bunnings delivered pleasing results, demonstrating the resilience of its operating model and its ability to meet customers’ needs in a difficult operating environment. The division also delivered sales growth for the half, despite the significant disruptions and temporary store closures.

The Wesfarmers Chemicals, Energy and Fertilisers division also had pleasing results, reflecting a solid operating performance and higher commodity prices. There was also continued improvement in the performance of the Industrial and Safety division. Kmart Group and Officeworks were more significantly impacted by COVID-related disruptions.

Despite the challenges, Wesfarmers continued to advance its strategic priorities, investing in the development of a market-leading data and digital ecosystem and progressing the construction of the Mt Holland lithium project.

Looking ahead and the economic conditions in Australia remain favourable, supported by strong employment and high levels of household savings.